epf contribution schedule 2019

First Quarterly Update to the FY 2023 Financial Plan Released. Employers must remit the employees contribution share based on this schedule.

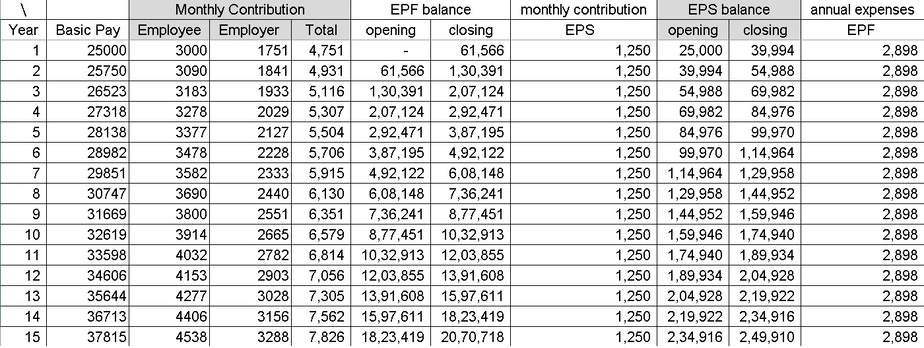

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

But in July 2017 Ministry of Labour Employment issued a clarification.

. Provide salary statements to employees. Employee TA Reimbursement Excel Template. 31-10-2019 and extended to the Union territory of Jammu and Kashmir and Union territory of Ladakh by notification No.

Basis EPF ESI 1 Acts Applicable The Employees Provident Funds And Miscellaneous Provident Act 1952. When is the best time to make the EPF contribution. Employee Resignation Schedule Excel Template.

Agency Meeting Schedule - Next Meeting. However companies with less than 20 employees can join this scheme as well on the basis of Voluntary. Contribution means a contribution payable in respect of a member under a Scheme 4or the.

As per paragraph 606 of EPF. Percentage of Basic salary contributed by Employee. You may contribute at your own schedule with the amount you feel comfortable with.

Updating and uploading of all Central Acts available on this web page is the proprietary of the Legislative Department in the Ministry of Law and Justice. The latest Adobe Acrobat Reader version 80 at. Employees State Insurance Corporation.

At First people from all the States in India except Jammu and Kashmir can apply under the provision of the EPF scheme. Insurance premium for education or medical benefit. Both the rates of contribution are based on the total.

Employers responsibility on EPF contribution. Like the Harmony and Tranquility modules the Columbus laboratory was constructed in Turin Italy by Thales Alenia SpaceThe functional equipment and software of the lab was designed by EADS. Register your employees as EPF members and keep their information updated.

Employees Provident Fund. Standard deduction increased for salaried persons from 40000 to 50000. Access to internet banking makes EPF contribution payments much easier now.

Meeting of the Not-For-Profit Contracting Advisory Committee 09132022. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. Yes theres a difference between contributing RM60000 at the beginning of the.

In early 2019 I registered myself for EPF i-Saraan previously known as 1Malaysia Retirement Savings Scheme or SP1M. Collect your employees share of EPF contribution and submit it to the EPF along with the. We look forward to his continued contribution John Lyman Ernst was originally appointed to the APA Board in June 2016.

Ernst served on the Regulatory Programs State Land Enforcement and the Park Policy and Planning. The contribution rate for employees and employers can be referred in the Third Schedule EPF Act 1991 as a guide. In this scheme govt.

I mandatory state-funded social security for the poor ii contribution-based system for workers earning up to a certain wage with part state-subsidy. As a Board Member Mr. Amendment of Third Schedule Order 2018.

For the Financial year 2019-2020 the pre-fixed rate of interest offered by the EPF scheme is 855. In the year 2016 or 2017 EPF introduced a few changes employees started thinking that if they dont contribute for 3 years they will not get interest on the balance amount. Contribution to the Social Security Organization SOCSO 250 Limited.

3 Organisation Employees Provident Fund Organization EPFO. Percentage of EmployerCompany Contribution to EPF. The updating and uploading of Rules Regulations Notifications etc and linking them with relevant sections of the respective Principal Act under which the said subordinate legislations have been made is the.

Changes in FY 2019-20 Interim Budget Feb 2019. Columbus is a science laboratory that is part of the International Space Station ISS and is the largest single contribution to the ISS made by the European Space Agency ESA. Full tax rebate us 87A for taxable income after all deductionsexemptions upto Rs 5 lakhs.

A A declaration that the members of the Respondent Trade Union and other similarly situated employees employed on contract basis by the Appellant-Company are entitled to the benefit of Provident Fund as per the EPF Act and the EPF Scheme and that the Appellant-Company be directed to forthwith enrol all such eligible contract. This scheme will increase the employment base of workers in the establishment and thus a large number of workers find jobs in such establishments. Pays full employers contribution towards EPF EPS both wef 01042018 for new employment.

Employees State Insurance Act 1948 Extends to Whole INDIA Whole India 2 Name of Scheme Employees Provident Fund Scheme. Register with the EPF as an employer within 7 days upon hiring the first employee. Must Read Pension Plans for NRIs in India Inoperative EPF Account Confusion.

Move from the current fragmented social security system to an integrated universal one with. September 15 2022 - Agenda Meeting Materials. Life insurance dan EPF.

The company will pay 175 while the staffworkers will contribute 05 of their wages for the Employment Injury Insurance Scheme and the Invalidity Pension Scheme. Percentage of Employee Contribution to EPF. 95 and the Fifth Schedule wef.

Secondly EPF account registration has compulsory for salaried employees with an income of fewer than 15000 Rs per month. A company is required to contribute SOCSO for its staffworkers according to the SOCSO Contribution Table Rates as determined by the Act. Deferred Annuity and Private Retirement Scheme PRS - with effect from year assessment 2012 until year assessment 2021.

The Words except the State of Jammu and Kashmir omitted by Act 34 of 2019 s.

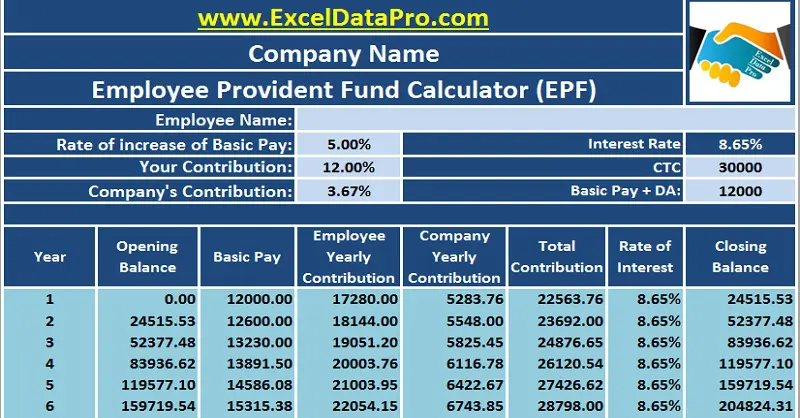

Download Employee Provident Fund Calculator Excel Template Exceldatapro

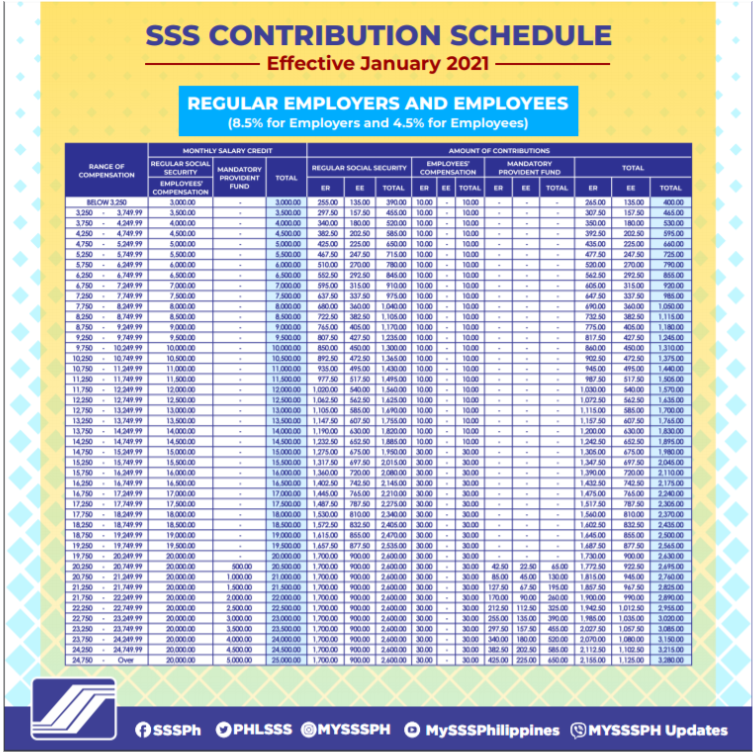

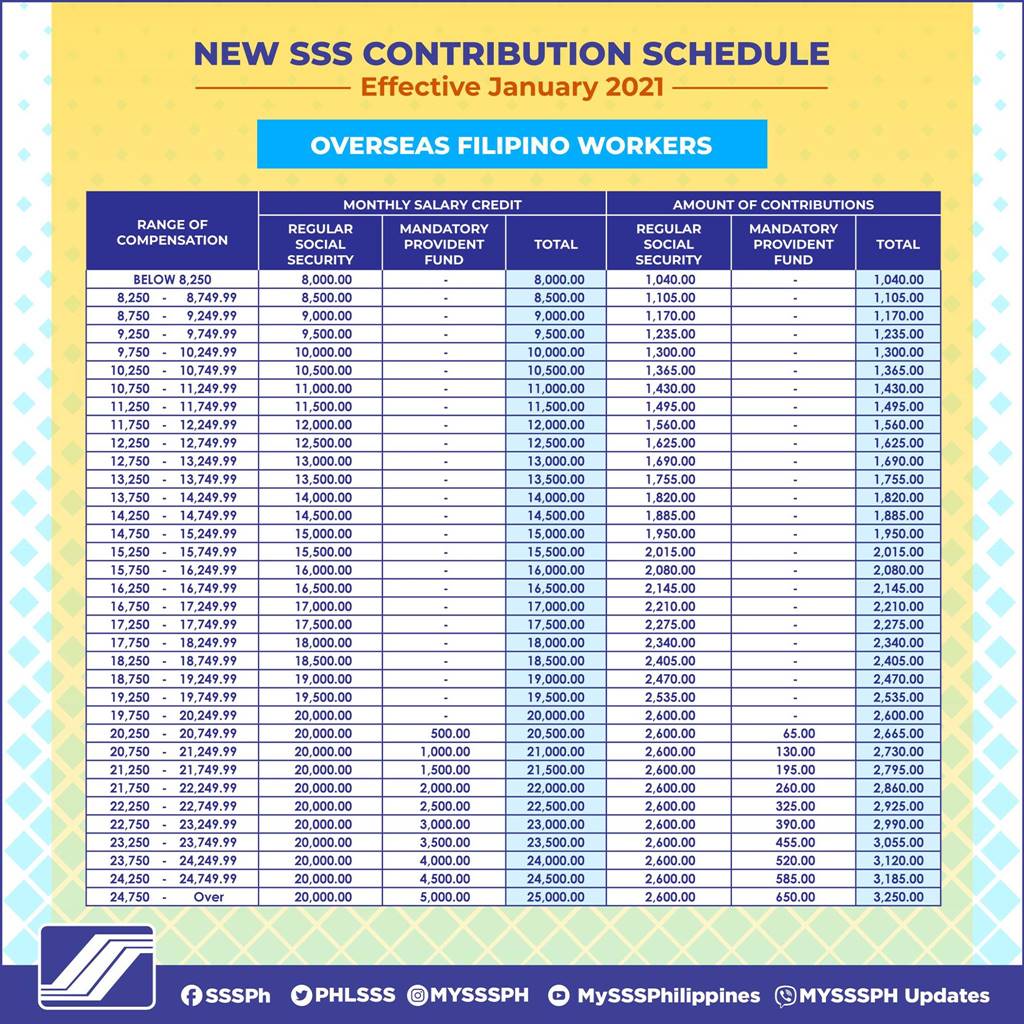

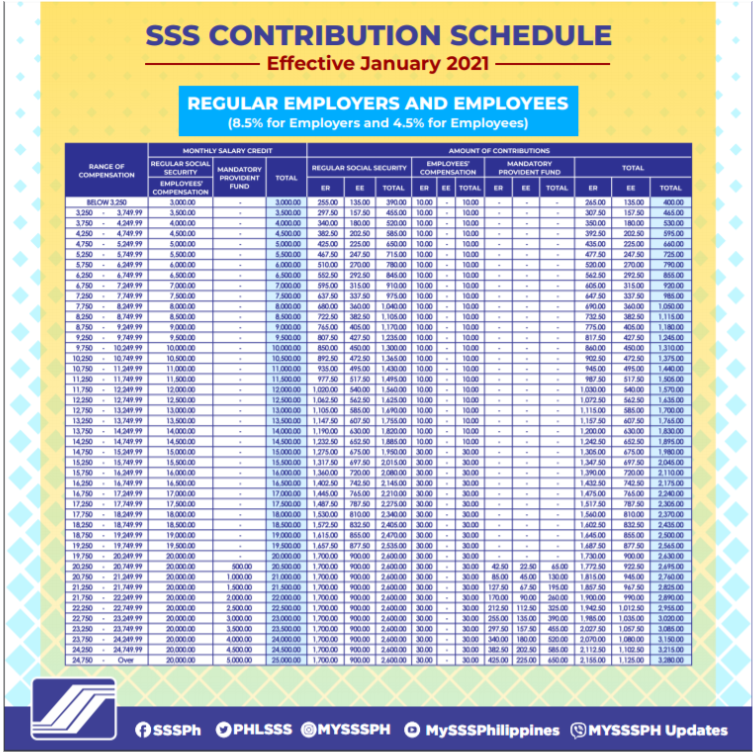

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

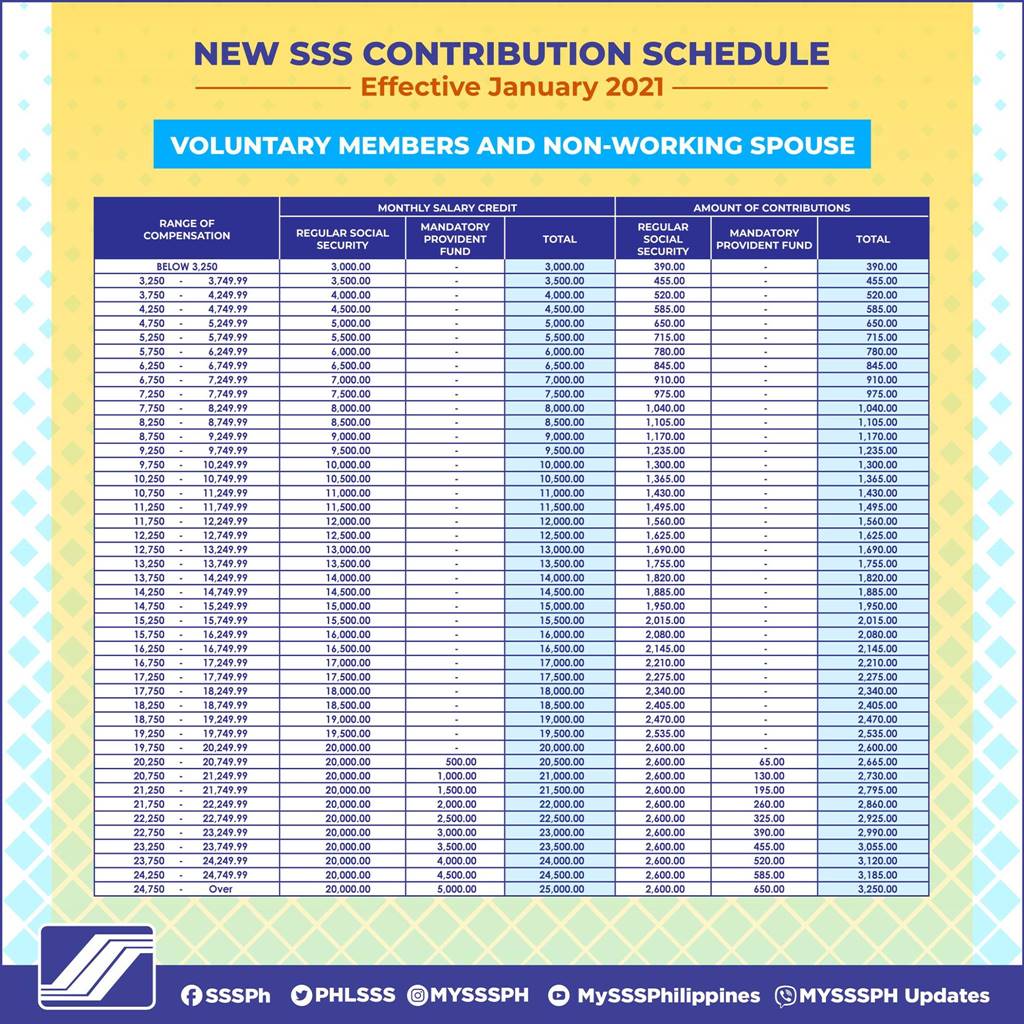

Hr Talk Top 13 Questions Answered On The New Sss Mandatory Provident Fund Aka Wisp Program Tina In Manila

Reduction In Epf Contribution Could Pose As A Risk In The Long Run Business Standard News

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Pin By Chin Eu On Epf Kwap Ltat Lth Pnb Ptptn Investing Periodic Table Estimate

30 Nov 2020 Bar Chart Chart 10 Things

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Download Employee Provident Fund Calculator Excel Template Exceldatapro

20 Kwsp 7 Contribution Rate Png Kwspblogs

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

How To Calculate Your Sss Contribution Sprout Solutions

Mandatory Seeding Of Aadhaar Number With Uan Till 30 11 2021 Employment Government Organisation

Top 5 Best Tax Saving Elss Mutual Funds 2021 22 Mutuals Funds Fund Investing

New Sss Contribution Table 2019 With Computations Pinoymoneytalk Com Contribution Money Talks Guidelines

Why Should You Withdraw Old Epf Account Balance In Operative Epf A C Timeline Investment In India Accounting Personal Finance

Sss Monthly Contribution Table Schedule Of Payment 2022 The Pinoy Ofw

No comments for "epf contribution schedule 2019"

Post a Comment